Hedge Fund, Family Office or Institutional Investor

Solutions for Hedge Funds, Family Offices & Institutional Investors

Custom Strategies. Smarter Allocations. Diversification Redefined. Gravity Investments empowers institutional investors with breakthrough tools for portfolio construction, optimization, and strategy deployment—backed by a fiduciary-first framework and a focus on true diversification.

Launch Custom Strategies—Fast

Take your hunches, ideas and hypotheses and challenge us to make a coherent strategy from them. Invest only after validation.

With Gravity, you can design, review, and implement bespoke strategies tailored to your investment thesis or mandate. We allow you to validate and analyze the portfolio strategy before investing, ensuring transparency, precision, and alignment with your objectives.

Highlights:

- Custom SMA or model portfolio strategy setup within days

- Full transparency and strategy review before funding

- Ideal for hedge funds, SMAs, custom indexes, or internal mandates

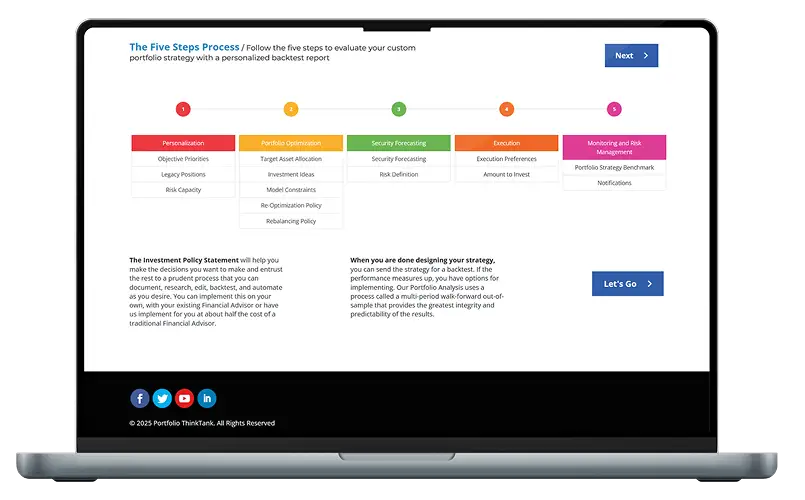

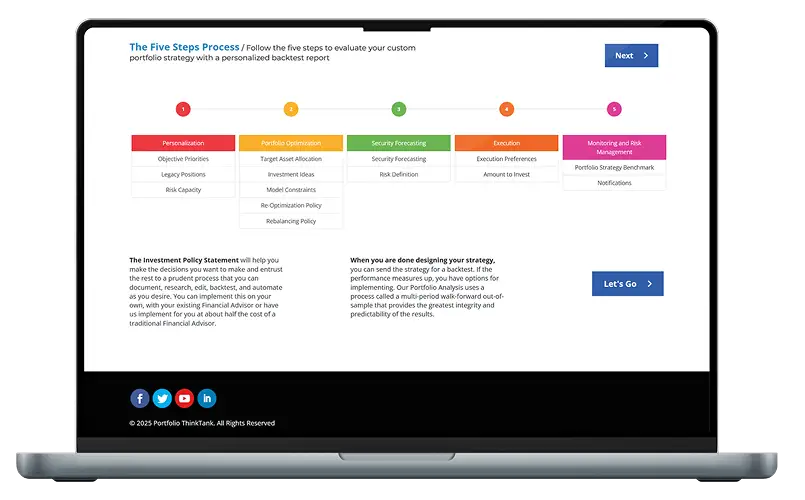

- Do it yourself with out software (Click here)

Smarter Asset Allocation & Portfolio Optimization

Your top-level asset allocation should reflect your real exposures—not just a textbook pie chart.

Gravity’s optimization engine leverages Diversification Optimization (DVO), our proprietary framework that quantifies true diversification across assets. This enables:

- Tailored portfolios, even with concentrated holdings

- More realistic and resilient allocation plans

- Alignment with multi-asset, multi-generational mandates

- Use our Pre-Trained Deep Learning Prediction Model, Bring your own model (Excel or .PATH) or work with the Gravity team to tune your own deep learning model that invests using your preferences, logic and rules

Perfect for:

- Family offices with legacy positions

- Endowments seeking higher efficiency

- Hedge funds balancing discretionary and systematic mandates

- Sovereign Wealth Funds or Institutions seeking to optimize your top level asset allocation policies for great efficiency

- Any Fiduciary of an underfunded Defined Benefit Plan – whose consequently must be an absolute return investor

Convert Passive Index Strategies to Diversification Weighted™

What if your S&P 500 or QQQ exposure could be reengineered for smarter diversification—without sacrificing exposure?

Gravity enables you to replicate any capitalization-weighted index strategy as a Diversification Weighted™ portfolio. Add your preferences—exclude ESG violators, competitors, or non-aligned industries—and maintain core exposure while improving balance, resilience, and control.

Control Your Passive Exposure:

- Custom-built DVO alternatives to QQQ, SPY, or IVV

- ESG filtering, competitive exclusion, or thematic overlays

- Better tailoring to your objectives. Your passive ETF strategies are not aligned to your objectives

- Maintain core beta while enhancing internal fit

Don’t think market cap weighted strategies are beatable?

Need to see the prove?

Your Platform for Institutional Innovation

Whether you’re allocating capital for a hedge fund, a multi-generational family office, or a sophisticated institution.

Gravity’s platform is built to deliver:

- Institutional-grade analytics

- AI-enhanced optimization

- Real-time rebalancing logic

- IPS alignment & fiduciary audit trails

- API or white-label deployment