Deliver Better Portfolio Solutions -> Better Investment outcomes and a healthier business as well.

Locate and save vulnerable accounts, diversify, optimize and automate strategies all the while improving margins, revenue and take rate.

Demonstrate and document a fiduciary-complaint process in accordance with best interest and laws requiring the documentation and mitigation of conflicts of interest for dually registered representatives that offer commissioned products.

Our objective optimization delivers solutions that meet the requirements for skill, loyalty and prudence.

Select which options you want help solving

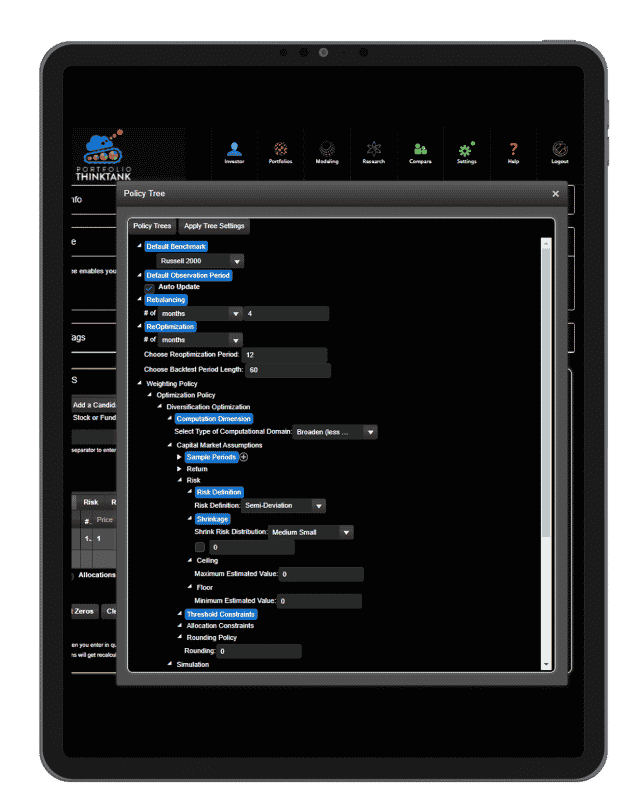

Gsphere is a powerful digital advice platform that features Gravity’s pioneering work in the science of diversification. Portfolio Re-Optimization Technology raises the standard of asset allocation with strong analytics, onboarding proposals, backtesting, and automation.

Whether you want to implement your own digital advisors platform, provide

recommendations, get compliant on diversification and process documentation,

or just create better portfolios; we got you covered:

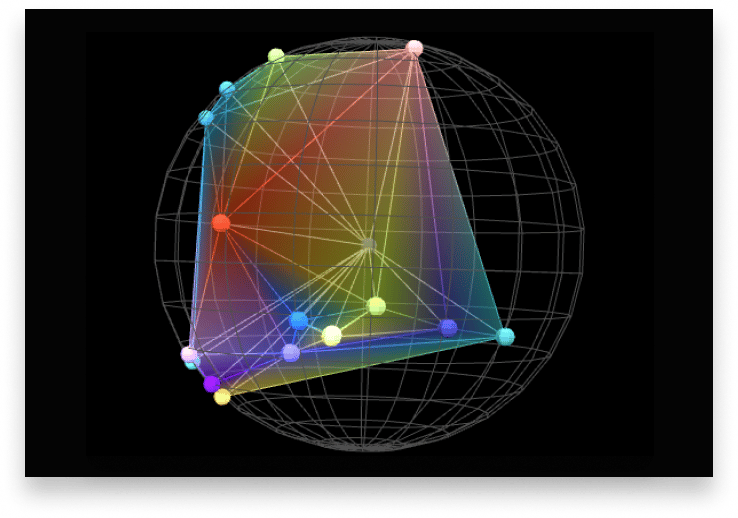

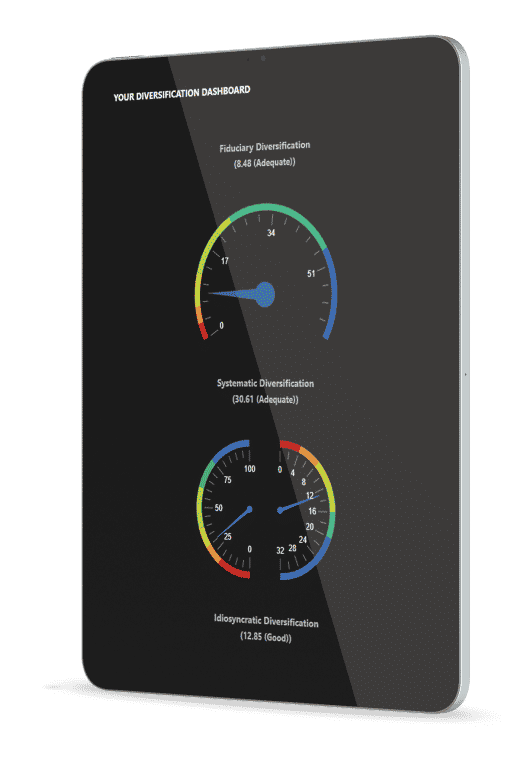

A picture is worth a thousand words. So tell investors what they need to learn about diversification and risk using our layered holistic portfolio view. With balance depicted as physical balance, it could not be more intuitive. It’s like a 3D MRI for your investing account.

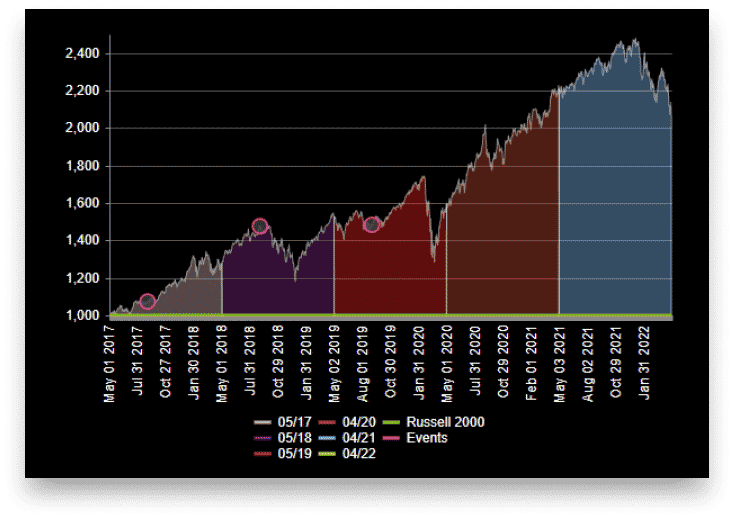

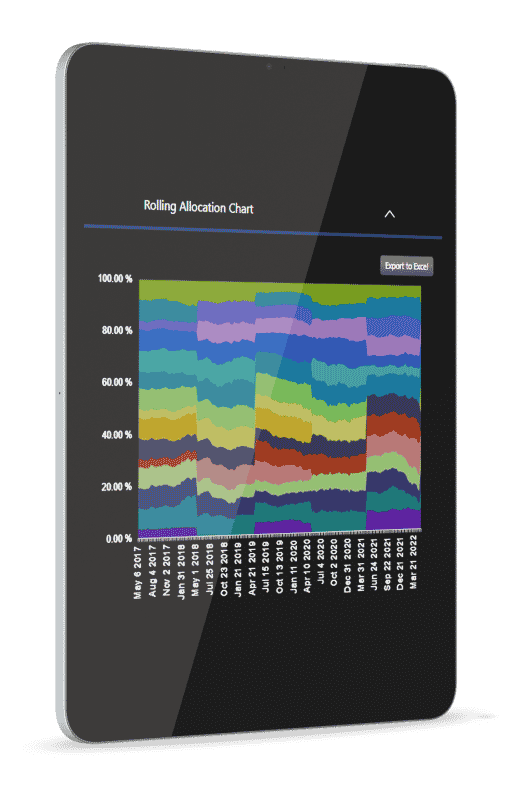

Asset allocation is when you designate a plan to follow. Portfolio optimization is when you perform asset allocation efficiently, given the investor’s objectives. Finally, portfolio Re-Optimization is when you optimize the portfolio regularly, knowing that the markets will constantly be changing and the best portfolios change with the times. Combining diversification and re-optimization with a hint of momentum, we think there is a sweet spot that won’t chase performance, stays in tune with the market, and protects investor capital from unknown risks.

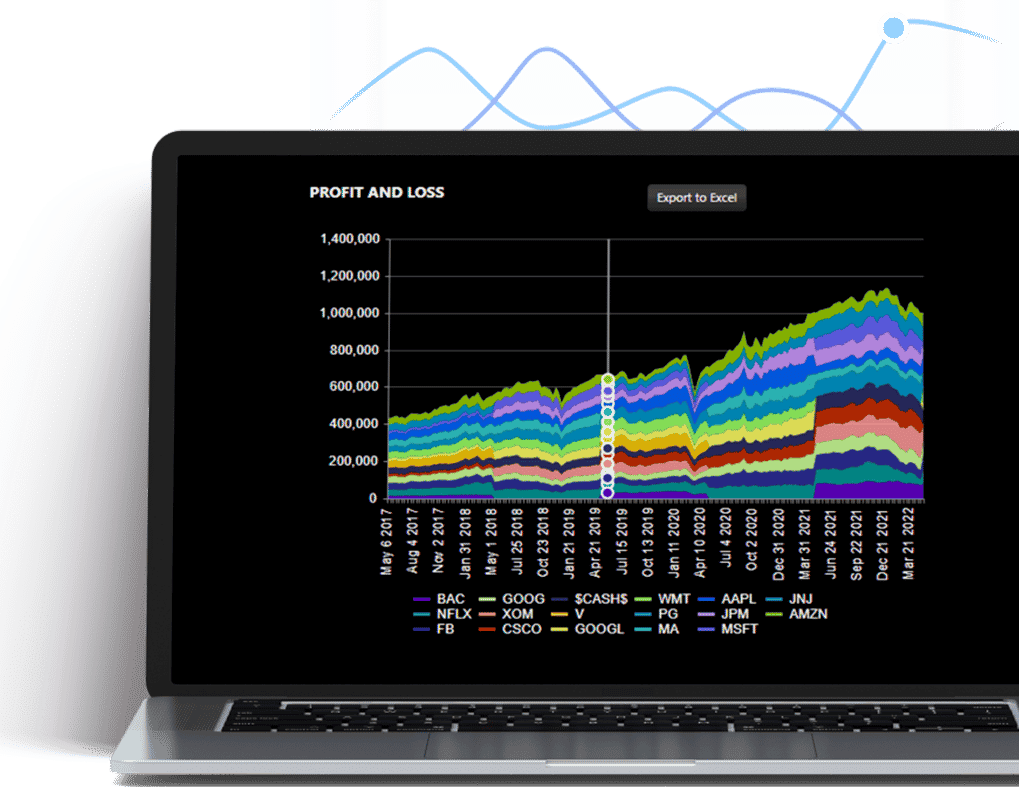

Portfolio Backtesting shows how the investment strategy performs over time. When creating custom portfolio strategies for investors, the backtest serves as a crucial proof statement.

We patented Diversification Optimization, Diversification Visualization, and Diversification Measurement. It’s time to bring diversification to the table for all of your investor conversations. Risk, return, and diversification. And since most investors have much worse diversification than they think, you can objectively illustrate how they are positioned and what they need to do to fix it.

Portfolio Comparisons is the ultimate before and after tool. Put it on the big screen and win more HNW business. Offer a free portfolio review. Teach, visualize and practice better diversification.

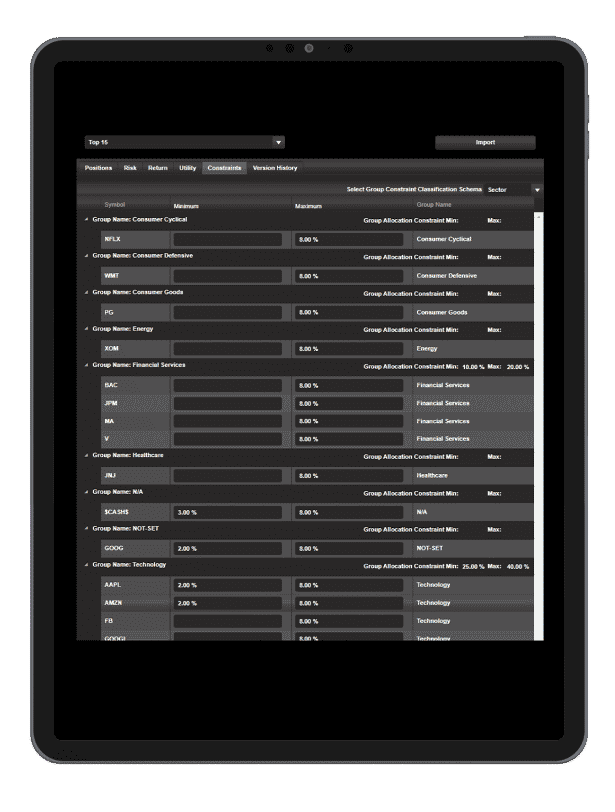

An optimal portfolio is only optimal if it is implemented. Often, we need to specify the blueprints of the portfolio strategy to ensure we don’t take on additional risk by succumbing to various concentrations. We control these concentrations and risks to help ensure a pragmatic, implementable portfolio by providing constraints: This includes minimum & maximum position contractions, threshold constraints, and group constraints by various classifications such as sector, industry, asset class, and asset type.

Evaluate your performance and see results yourself

Founder and inventor of RAMCAP, the "intelligent asset allocator" one of the first desktop investment diversification systems; Former Adjunct professor to the College for Financial Planning; Co-Creator of one of the first "Fund of Funds" hedge funds - twice named in the top 10 by the Wall Street Journal.

Whether you want to implement your own digital advisors platform, provide

recommendations, get compliant on diversification and process documentation,

or just create better portfolios; we got you covered:

At Portfolio ThinkTank, diversity does not end with the portfolio. Instead, we strive to create a culture that embraces diversity proactively, protects our ecosystem from fear and hate, and celebrates the beauty of our differences.

© 2025 Gravity Investments. All Rights Reserved

Gravity Investments is an Institutional RoboAdvisory company that works with Registered Investment Advisors, Broker/Dealers and Institutional Investors, in a collaborative fashion, to optimize and automate custom portfolio solutions; helping them to offer a white label robo advisor solution to their clients.

The cornerstone of Gravity Investments is Gsphere, an automated digital advice platform and hybrid robo advisor born from a history of advanced analytics and portfolio optimization. The core Diversification Optimization™ engine produces Diversification WeightedⓇ strategies and can support and improve nearly any asset type or strategy.