About Gravity

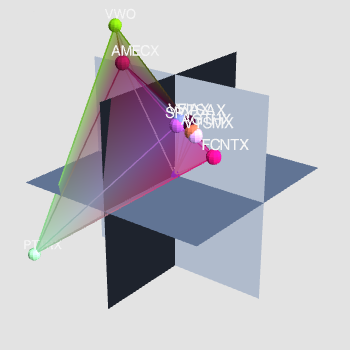

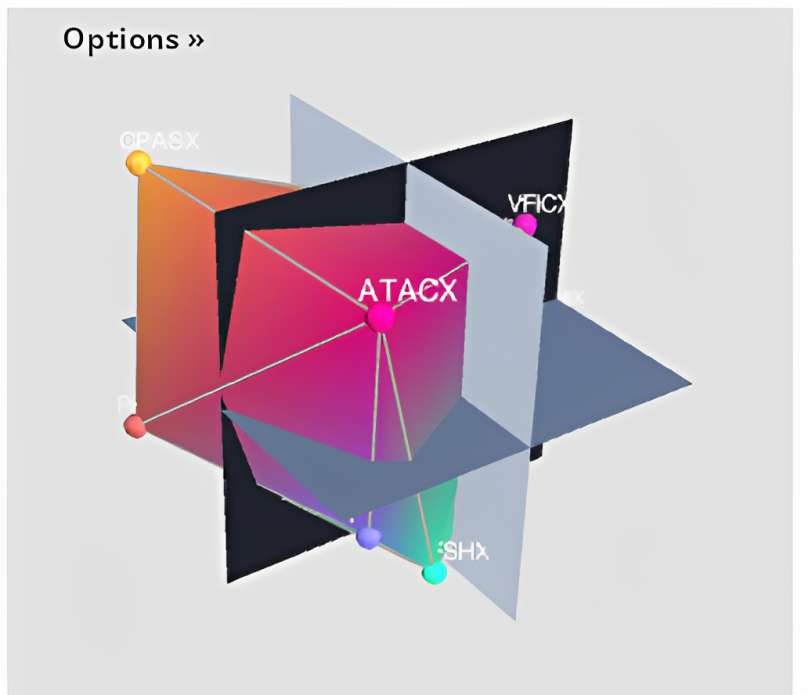

Use our patented diversification visualization and measurement technologies to properly diagnose any portfolio. This powerful portfolio analysis will give you new perspective and help you better serve investors.

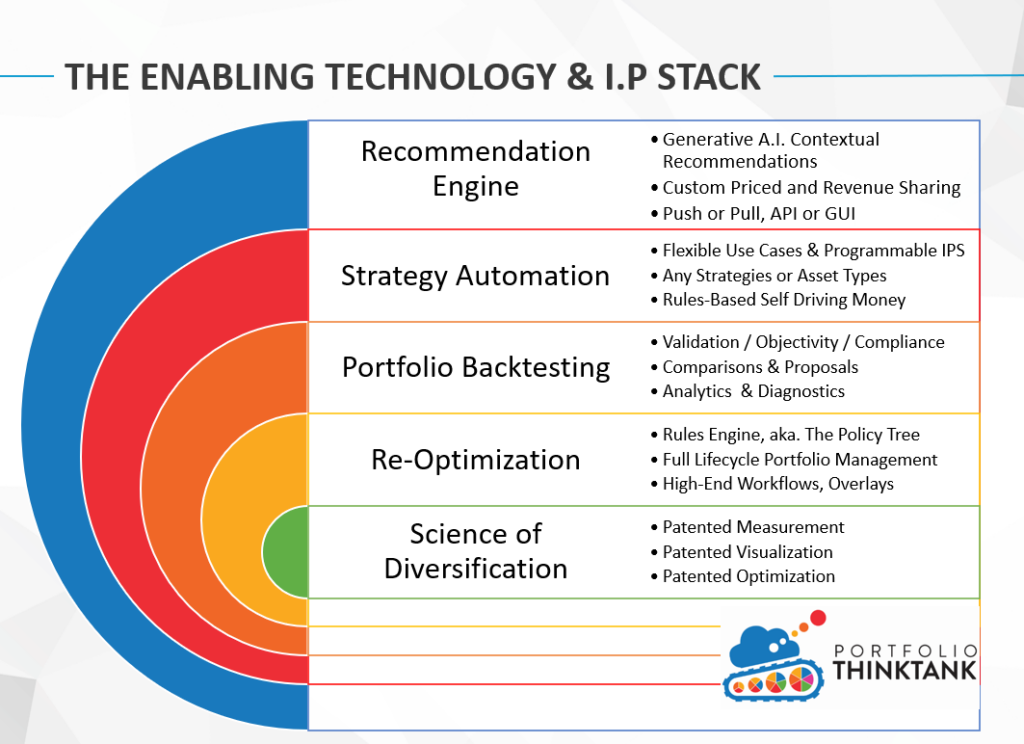

Diversification Optimization creates Diversification Weighted® portfolios. Our rules based optimization engine allows for any portfolio to be back tested, optimized and automated.

The time has passed when investment fiduciaries may be blind to their portfolios Diversification. Gsphere provides the tools for serious investors. Our portfolio visualizations will leave an indelible impression in the minds of your clients and prospects giving you a big advantage in competitive opportunities.

Hybrid RoboAdvisor

Let's meet and you can configure the digital advice platform to take you to the next level, in weeks not months.

Institutional Portfolio Analytics

Powerful portfolio analysis cuts through the clutter and answers the questions: Is this portfolio good enough? Is this Portfolio Strategy better than what I had before?

Programmable Investment Policy Statements

An Investment Policy Statement serves your investors by enabling them to design the portfolio they want, we optimize, backtest and automate and trade it for you - at whatever broker you choose -

Where we began…

In 2000, James Damschroder had a flash of genius which inspired the creation of the robust software application Gsphere, which is the foundation of the Gravity’s approach. Gsphere embraces powerful 3D diversification patented technology.

Today…

As Gsphere became interrelated in their client’s portfolio strategy architecture and performance optimization; it became a natural progression to start a Registered Investment Advisory company. Therefore, we created a sister company, called Gravity Capital Partners, in 2010. Today, both companies are owned by Gravity Investments Inc.

Overview…

Despite the widespread acceptance of diversification as an integral investment benefit for portfolio construction, the fact remains that there has not been a real genuine method to quantify either diversification’s existence or the diversification’s effect on a portfolio, until the invention of Gsphere. Gravity can show you through rigorous research completed on real-life portfolios, a tried and true method to effectively measure and manage diversification with maximum risk mitigation.

Excerpt from Wall Street Technology: Using 3-D modeling also addresses the 2-D limitation of correlating assets as pairs, Rossi says. “There are few people who can glean the nuances of information presented in a two-dimensional table of 30 rows by 30 columns, he asserts.” In 3-D, each asset’s relationship with all of the others in the portfolio leaps off the computer screen.” Quote by Vincent Rossi of Intelligent Capitalworks

Our Mission

“Gravity’s mission is to Bring Life to Diversification: with our pioneering work in the science of diversification, we empower the industry’s knowledge and application of True Diversification. We execute our mission with custom systematic portfolio strategies and recommendations delivered through our automated digital advice platform.

Our platform, constantly evolving and improving, is the ultimate performing digital advice platform; trusted throughout the industry for our leadership, integrity, service, and commitment to investor success.”

– James Damschroder, Founder and CEO