Digital Advice Platform

The cornerstone of Gsphere is our breakthrough digital advice platform and discoveries in the science of portfolio diversification. What do you know about Gravity Investments?

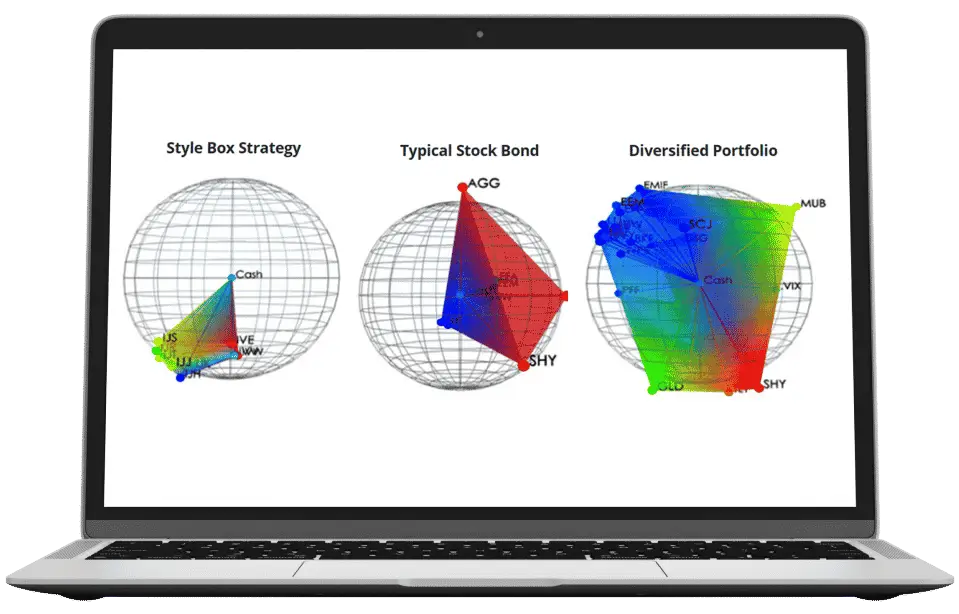

Use our patented diversification visualization and measurement technologies to properly diagnose any portfolio. This powerful portfolio analysis will provide you with a new perspective and help you better serve investors.

Diversification Optimization creates Diversification Weighted® portfolios. Our rules-based optimization engine allows any portfolio to be backtested, optimized, and automated.

This portfolio rule engine is sophisticated and powerful, and it is favored by investment professionals who care about the strategies they recommend.

The time has passed when investment fiduciaries can afford to be blind to their portfolios’ diversification. Gsphere provides the tools for serious investors. Our portfolio visualizations will leave an indelible impression on your clients and prospects, giving you a significant advantage in competitive opportunities.

Inventors of the 3D Portfolio Visualization

Style Boxes

Stocks and Bond

True Diversification®

Why Diversification Matters?

-

It is the law:

- Failure to diversify on a prudent and reasonable basis in order to reduce Uncompensated Risk is ordinarily a violation of both the duty of caution and the duties of care and skill.” —

Restatement (Third) of Trusts §227, “Comment on Basic Duties of Prudent Investor,” p. 23]

- Supreme Court precedent explicitly states that liability exists in perpetuity.

- Failure to diversify on a prudent and reasonable basis in order to reduce Uncompensated Risk is ordinarily a violation of both the duty of caution and the duties of care and skill.” —

-

It Works:

- See the Research

How It Works About Gravity Investments

Gsphere empowers advisors with the ability to quantify, visualize, and maximize true diversification through one of the most powerful asset allocation technologies available today. Your clients will benefit as Gsphere software provides the ability to optimize model portfolios that generate the greatest return with the least amount of risk.

Benefits of using Gsphere include:

- Measure diversification to reduce portfolio risk.

- Effective Rebalancing for Greater Risk-Adjusted Returns.

- Visual Analysis and Optimization for Superior Portfolio Balancing.

Where we began…

In 2000, James Damschroder had a flash of genius that inspired the creation of the robust software application Gsphere, which is the foundation of Gravity's approach. Gsphere embraces powerful 3D diversification technology.

Today…

As Gsphere became integral to their client's portfolio strategy architecture and performance optimization, it was a natural progression to start a registered investment advisory company. Therefore, we created a sister company called Gravity Capital Partners in 2010. Today, both companies are owned by Gravity Investments, Inc.

Overview…

Despite the widespread acceptance of diversification as a key benefit for portfolio construction, there has not been a genuine method to quantify either its existence or its effect on a portfolio—until the invention of Gsphere. Gravity, through rigorous research on real-life portfolios, has developed a tried-and-true method to effectively measure and manage diversification with maximum risk mitigation.

“In the industry today, 3D diversification, not risk, is being merited as the focus for portfolio optimization and asset allocation construction.”

Excerpt from Wall Street Technology: Using 3-D modeling also addresses the 2-D limitation of correlating assets as pairs, says Rossi. “There are few people who can glean the nuances of information presented in a two-dimensional table of 30 rows by 30 columns,” he asserts. “In 3-D, each asset’s relationship with all of the others in the portfolio leaps off the computer screen.”

Vincent Rossi, Intelligent Capital, works

Our Mission

“Gravity’s mission is to Bring Life to Diversification: with our pioneering work in the science of diversification, we empower the industry’s knowledge and application of True Diversification. We execute our mission with custom systematic portfolio strategies and recommendations delivered through our automated digital advice platform.

Our platform, constantly evolving and improving, is the ultimate performing digital advice platform; trusted throughout the industry for our leadership, integrity, service, and commitment to investor success.”

– James Damschroder, Founder and CEO

History

FOUNDED GRAVITY INVESTMENTS BASED ON CHASING TO GROUND THE INSPIRATIONAL QUESTION, “ WHAT IF YOU PUT A THIRD DIMENSION ON THE EFFICIENT FRONTIER?”

FIRST RELEASE OF GSPHERE, DESKTOP PORTFOLIO OPTIMIZATION SOFTWARE

PATENT ISSUED FOR CREATING A VISUAL REPRESENTATION OF A PORTFOLIO

LAUNCHED GRAVITY CAPITAL PARTNERS, A REGISTERED INVESTMENT ADVISOR TO SUB ADVISE ON CLIENT ASSETS

LAUNCHED FIRST WEB AND MOBILE VERSIONS

AUTOMATIC WALK FORWARD BACKTEST

GRAVITY INVESTMENTS LLC BECAME GRAVITY INVESTMENTS INC

GRAVITY INVESTMENTS LLC BECAME GRAVITY INVESTMENTS INC

LAUNCHED A HYBRID ROBOADVISOR, ONE OF IF NOT THE FIRST SUCH SYSTEMS IN THE INDUSTRY

LAUNCHED PORTFOLIO THINKTANK FOR INDIVIDUAL INVESTORS

PORTFOLIO THINKTANK ACQUIRES GRAVITY INVESTMENTS

DEVELOPMENT OF API AND WEB SERVICES

RELEASE OF MACHINE LEARNING PREDICTION SYSTEMS

Join as an Affiliate

10% Commissions for all first year revenue for all products Import Screen Results with Copy and paste ticker extractor 90 day cookie expiration policy

Join as an Affiliate Partner

8.5% Annual Lifetime Revenue ShareNo time limitations on conversions Custom resources

Stock Screener Integration

Exclusive sponsorship of the screen results page Ongoing marketing Joint Promotions

Why Partner with Gravity

Approximately $30 billion has been professionally managed using our patented software as a service by our financial advisor and institutional wealth manager clientele, employing Gsphere Diversification Optimization™ portfolio technology. Our research-based Journal of Index, Legends of Indexing feature issue, found that our results generated over 400 basis points annually compared to the cap-weighted S&P 500.

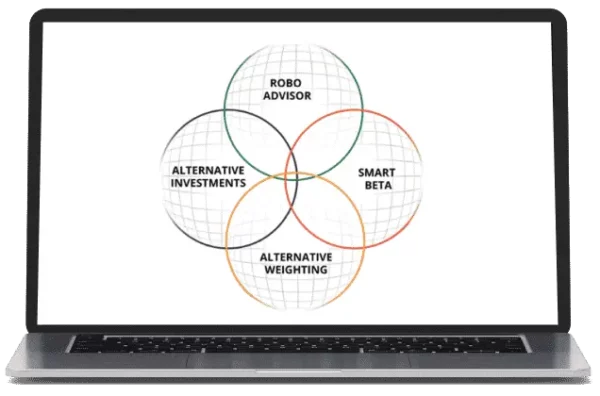

Diversification Weighted® Strategies are systematic, quantitative, and replicable. Unlike other weighting approaches, we offer an inherent ability to work across all security instruments, asset classes, and investment strategies. Our patents and technologies for diversification measurement, visualization, search, and optimization are seminal and profound. Our holistic 3D portfolio visualizations (below) expose diversification deficiencies in prospect’s former strategies and held away accounts and drive demand for a balanced investment solution.

Our Value Propositions

Win new business

Attract new investors with our easy to embed tools in your website.

Compete and thrive in any opportunity

Diagnose any portfolio & find hidden risks. Then build objective, verifiably diversified portfolios that better serve investors.

Do right by your clients and be a better fiduciary

Nurture loyal clients, facilitate referrals and manage your fiduciary liability.

Expand and enterprise

Whenever you are ready, team with Gravity to implement automated and optimized portfolios: Your choice: Models or even custom tailored accounts.

Core Values

We strive to demonstrate our core values with every interaction. If you believe that your interaction fell short,

especially if it is me, please let me know– James Damschroder (@) gravityinvestments.com

As

Featured In