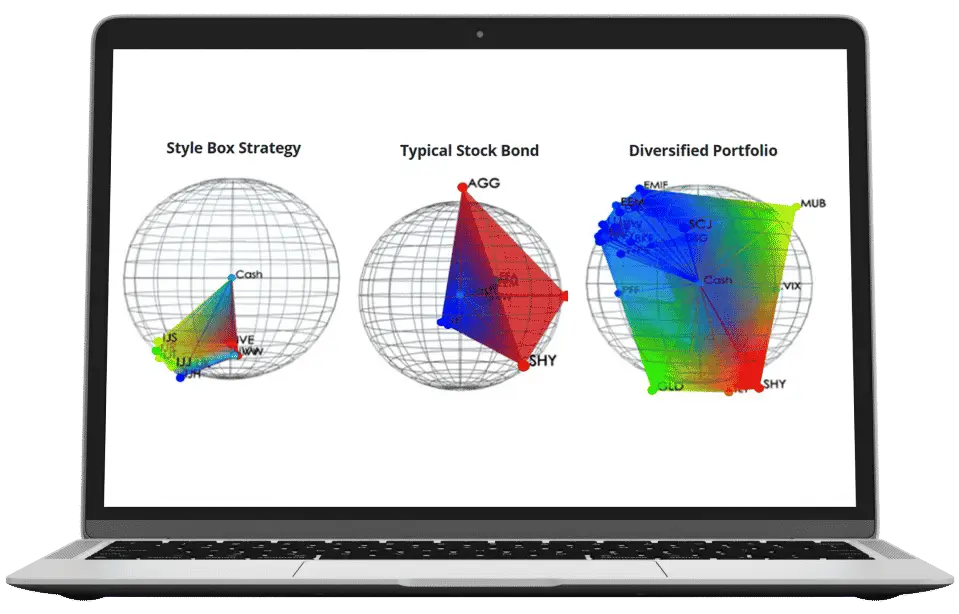

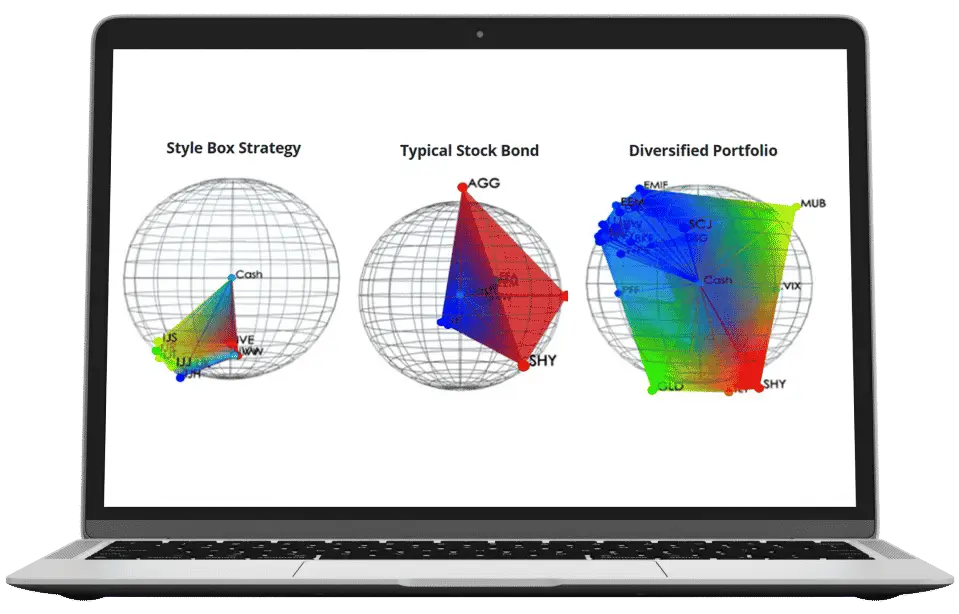

The cornerstone of our Asset Allocation Software lies in our breakthrough discoveries in the science of portfolio diversification. Use our patented diversification optimization, visualization and measurement technologies to diagnose any portfolio properly.

This powerful portfolio analysis will give you a new perspective and help you better serve investors.

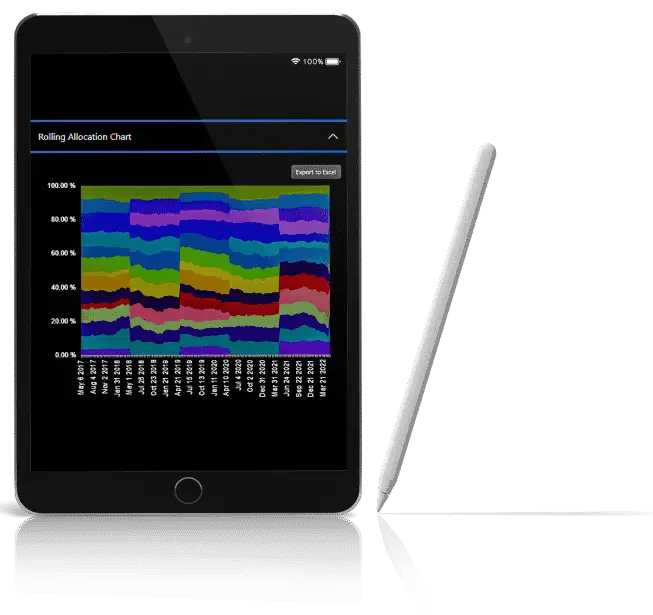

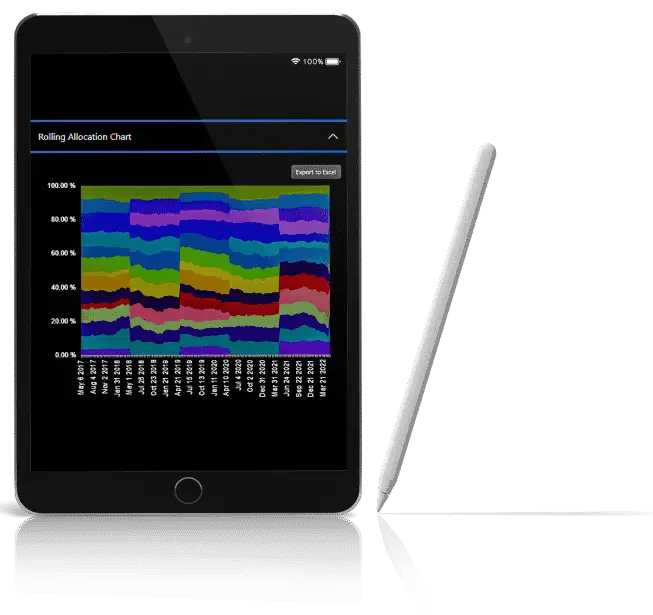

Diversification Optimization (DVO) creates Diversification Weighted® portfolios. Our rules-based optimization engine allows any portfolio to be backtested, optimized, and automated. This portfolio rule engine is sophisticated and powerful. As a result, it is favored by investment professionals who care about the investment strategies they recommend.

The time has passed when investment fiduciaries may be blind to their portfolios’ diversification.

Gsphere provides the tools for serious investors. Our visualizations will leave an indelible impression in the minds of your clients and prospects, giving you a significant advantage in competitive opportunities.

Portfolio diversification is not eggs and baskets or vague flimflammery. It is a definitive science – and one the most predictable measures for portfolio analysis… But is it important? Find out here

Supreme Court precedent explicitly states that liability exists in perpetuity.

See the Research

Gsphere empowers Advisors with the ability to quantify, visualize and maximize true diversification through one of the most powerful asset allocation technologies available today. Your clients will benefit as Gsphere software provides the ability to optimize model portfolios that generate the greatest return with the least amount of risk.

Our platform, constantly evolving and improving, is the ultimate performing digital advice platform; trusted throughout the industry for our leadership, integrity, service, and commitment to investor success."

Approximately $30 Billion has been professionally managed with our patented software as a service by our financial advisor and institutional wealth manager clientele using Gsphere Diversification Optimization™ portfolio technology. Our research-based Journal of Index, Legends of Indexing feature issue researched results generated over 400 basis points annually compared to the cap-weighted S&P 500.

Diversification Weighted® Strategies are systematic, quantitative, and replicable. Unlike other weighting approaches, we offer an inherent ability to work across all security instruments, asset classes, and investment strategies. Our patents and technologies for diversification measurement, visualization, search, and optimization are seminal and profound. Our holistic 3D portfolio visualizations (below) expose diversification deficiencies in prospect’s former strategies and held away accounts and drive demand for a balanced investment solution.

Attract new investors with our easy to embed tools in your website.

Diagnose any portfolio & find hidden risks. Then build objective, verifiably diversified portfolios that better serve investors.

Nurture loyal clients, facilitate referrals and manage your fiduciary liability.

Whenever you are ready, team with Gravity to implement automated and optimized portfolios: Your choice: Models or even custom tailored accounts.